Trust underpins everything

We love investing. We were born to invest. The team is all in committed to deliver returns for our investors.

We manage the Sterling Select Companies Fund – a UCITS Fund which is a collection of overlooked, under-researched and mispriced companies.

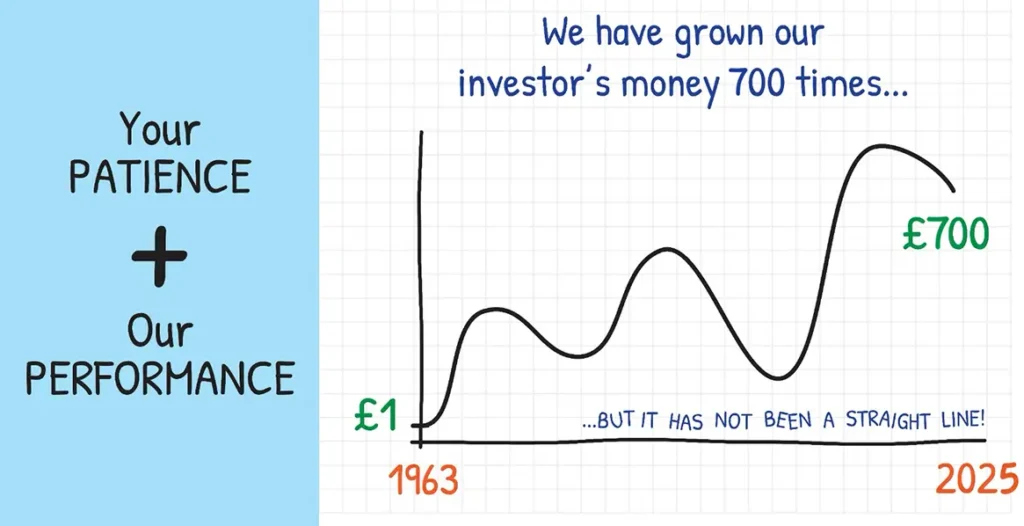

In a world that seeks instant gratification we are happy bunnies investing for the long term. However, we are not lazy, we do not buy and forget; more like buy and monitor.

Business is all about people. Hence we only invest in first-class people we admire and trust.

We own the firm so think like owners and invest in the Fund ourselves.

We manage the Sterling Select Companies Fund – a UCITS Fund which is a collection of overlooked, under-researched and mispriced companies.

In a world that seeks instant gratification we are happy bunnies investing for the long term. However, we are not lazy, we do not buy and forget; more like buy and monitor.

Business is all about people. Hence we only invest in first-class people we admire and trust.

We own the firm so think like owners and invest in the Fund ourselves.